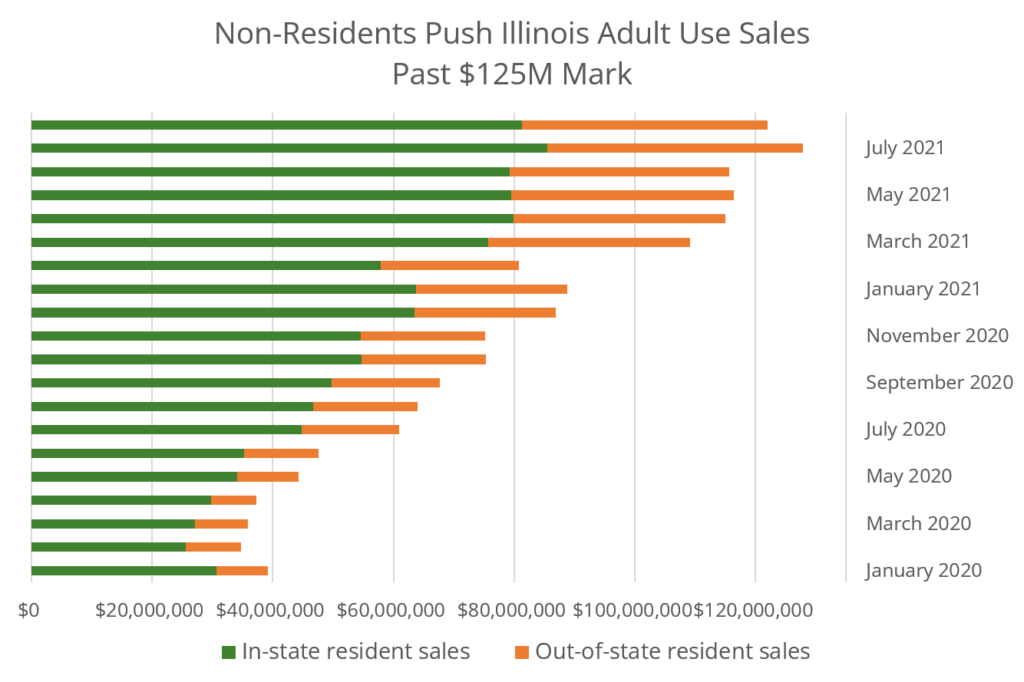

The Illinois cannabis market is booming. Adult-use sales alone have exceeded $100M for six months running, and no doubt September will follow as both July and August topped $120M in sales. The state will eventually fix the many problems snarling the application and lottery process, driving sales higher. Surrounded by states with limited (or virtually nonexistent) cannabis programs, the Land of Lincoln will continue pulling in substantial dollars from its neighbors. Wisconsin Gov. Tony Evers (D) famously expressed his feelings on the issue, saying he was tired of getting flak from Illinois Gov. JB Pritzker (D) about it: “Whenever I get with [Pritzker], he thanks me for having Wisconsinites cross the border to buy marijuana.”

Adult-use sales to August 2021, as reported by the Illinois Department of Financial and Professional Regulation (September 2, 2021)

Adult-use sales to August 2021, as reported by the Illinois Department of Financial and Professional Regulation (September 2, 2021)

But it isn’t just Midwesterners from out of town getting into Illinois cannabis. For cannabis brands outside the Land of Lincoln, a market set to blow past the $1B mark again in 20201 makes for an obvious expansion opportunity. The growth – and the visitors driving some of it – presents opportunities for existing players in Illinois as well. The customer base is the same for both, but the path to gain and grow share is markedly different. Recent conversations with industry leaders uncovered some learnings illustrating how cannabis companies are engaging with the Illinois market:

For insights on Illinois as a linkage in a multi-state strategy, Allison Disney of Receptor Brands shared her experience working with Cresco Labs, and… George Allen, Chairman of the Board for Lowell Farms, described how an iconic brand from California views the opportunity in the Prarie State.In 2019, Cresco Labs operated five dispensaries under four different names (MedMar, PDI Medical, FloraMedex, and Phoenix Botanical) in the company’s home state of Illinois. Like Illinois, Cresco had seven other different retail brands scattered across other states. As expansion and acquisition continued, the company found itself lacking a signature retail brand.

Thus the company went on to rebrand all of its retail operations under the Sunnyside banner. CEO Charlie Bachtell commented on the Sunnyside vision in a press release on the opening of Cresco’s tenth Illinois store. (The company now operates 11 in the state.) Bachtell described Sunnyside dispensaries as suited to “vibrant retail spaces—on the same block as Costco, Whole Foods, and Starbucks.” To dig further into the DNA of the Sunnyside brand, we spoke to Allison Disney, a Founding Partner of Receptor Brands and alum of Chicago-based global agency Energy BBDO, on her experience with Cresco and Receptor’s latest work with the company.

Drawing from her work at Receptor with Cresco on major strategic initiatives, Disney described a Sunnyside retail store as “a safe and accessible space for anyone curious about cannabis.” In keeping with a company dedicated to “normalizing the shopping experience” (Bacthell’s words), Disney shared her perspective on the Sunnyside environment as intending to “create a retail experience that we as consumers have come to expect in general. You shouldn’t have to leave a Starbucks and then go to your dispensary and feel like you’ve entered another planet.” Disney posed the question she feels Cresco is inviting from consumers: “Am I willing to drive past a couple of other retailers in Chicago to get to Sunnyside because I know there is something about that experience that will be worth the effort?”

From Cresco Lab’s Instagram @crescolabs

From Cresco Lab’s Instagram @crescolabs

In a state where purchases by out-of-state visitors make up roughly thirty percent of sales, Disney’s additional call out of “approachable” as a key component of the Sunnyside brand makes perfect sense. The MSO not only retooled the Illinois stores but also implemented a national branding strategy for all its retail locations. In Disney’s words, she sees Cresco’s goal behind Sunnyside as creating “a consistent experience that meets expectations, so whether you go into a Sunnyside in Illinois or Pennsylvania, you know you are going to get the same experience no matter where you are in the country.” But Cresco seems well aware of the need to create links to the surrounding community as well. For instance, a recent AdAge write-up on Chicago as the “Silicon Valley of Pot”, featured Receptor’s work with Cresco on a store mural program bringing in local artists to paint murals inside Sunnyside dispensaries.

With travel hopefully approaching pre-Covid levels next year, Illinois might welcome over 100 million tourists in 2021. That will mean foot traffic through Cresco’s Illinois stores from tourists who might return home looking for a local Sunnyside.

But what of cannabis brands with no presence in Illinois?

Savvy cannabis smokers in Illinois have been delighted to discover that, through a licensing arrangement with Ascend Wellness Holdings, the iconic Lowell Smokes pre-roll pack has appeared in select Illinois dispensaries. Lowell Farms announced the arrival in August and in the subsequent weeks Smokes have reached more dispensaries beyond the eight initial locations at launch.

From Lowell Farms’ Instagram @LowellHerbCo

From Lowell Farms’ Instagram @LowellHerbCo

In a recent email exchange, Lowell Farms Chairman George Allen shared the following on the company’s perspective on cannabis in Illinois and Lowell’s approach to launching its renowned Lowell Smokes brand into a new market. The comments below have been edited for clarity.

High Yield: Knowing that the IL market is big and getting bigger, apart from that – is there anything about IL that looks especially attractive?

George Allen: It is an important moment in Illinois, Cannabis is recently legal recreationally and we want to be there to share that moment with consumers. It’s a magical time of discovery and exploration and we didn’t want to miss it. We want to build and learn from that moment and make sure consumers there get to contribute to the legacy of Lowell Smokes.

HY: What are your views on the Illinois market compared to Lowell’s “home” market?

GA: Selection is far more limited than California. Illinois is an oligopoly market that tends to limit selection and make pricing less consumer-friendly.

For those seeking more information, Headset published data on this pricing issue in a recent report on the Illinois market. The data can be found in “A high-level overview of the Illinois cannabis market” available with registration on the Headset site.

HY: Based on how dispensaries operate in IL, what changes – if any – did you make to your retail strategy?

GA: The budtender is the gatekeeper and the educator. As in California, we spend a lot of time making sure they know how much we care about quality.

HY: What messaging to dispensary operators about your brand has been most effective?

GA: Quality. We don’t cut corners, ever. That is critical, it builds trust and confidence.

HY: What is it about the consumer experience in Illinois that might be the most challenging for you?

GA: It’s getting crowded and our price point is higher than some competing brands. We sell an all-flower pre-roll and this is the exception in Illinois. Once the consumer is informed and knows the difference, they wouldn’t settle for less, but it is an education process.

HY: What do you think Illinois consumers will find most interesting when your products “hit the shelf”?

GA: The brand invites the curious, even those that are not comfortable or familiar with cannabis. When you have a pack of Lowells, you had better be prepared to share.

While Lowell Farms is hardly the first to grasp the importance of educating budtenders and fostering brand advocacy, the brand brings to bear several advantages. The equity of the Lowell Smokes brand is such that local connoisseurs took note of where and when the packs would hit the shelf. Other brands seeking a foothold in new states might not be able to demonstrate the same degree of hometown support by way of sales, the world of social media followers and micro-communities can do just as well, if not better among younger consumers, from a strategic perspective. The brand’s status in California also lends a degree of authenticity amidst the many “store brands” that make up a significant portion of the prerolls category in Illinois. Lastly, on an issue that any brand entering a booming market like Illinois can leverage, innovative new products (such as Lowell’s “whole flower” preroll) will draft off not only the growth of the market but also the growing sophistication of the Illinois consumer.

The post Players In the Prairie State appeared first on Cannabis Business Executive - Cannabis and Marijuana industry news.

Copyright

© Cannabis Business Executive